Pursuing a career in financial planning can be as rewarding as it is challenging. But success in this field, whether as a paraplanner or financial planner, is increasingly being determined by qualification success.

Although financial planners need to be Level 4 diploma qualified, there’s currently no minimum qualification requirement to become a paraplanner. However, a lack of qualifications will likely hinder your progress.

One thing’s for sure, the financial planning community continues to grow strongly and the number of candidates enhancing their professional standing in this area through exam achievements is rising rapidly. To maintain a competitive advantage over your peers, with the ability to also open-up more options and opportunities for your career, exam success at higher levels is fast becoming a necessity rather than a ‘nice to have’.

In this guide we highlight the cost of building a career in financial planning through the three primary bodies advocating financial planner and paraplanner status:

- The Chartered Institute for Securities & Investment (CISI)

- Chartered Insurance Institute (CII)

- The London Institute of Banking & Finance (LIBF)

We don’t advocate whether one qualification is better than another; each individual will have their own desires and expectations on the career path they wish to take and where they intend to end up, whether that be in support roles, paraplanning or financial planning.

On the following pages, we describe all the financial planning qualifications available and highlight the minimum cost required to achieve the respective designation.

This assumes no prior qualifications are held nor external study courses attended. A detailed costing of taking the exams is provided in the subsequent tables.

Of course, the higher the level of qualification taken, the greater the cost. These exams are not easy nor are they cheap. But remember, with astute investment comes the potential for greater rewards in terms of salary, recruitment and professional standing over the longer term.

Whichever route you take to build your financial planning career, we wish you the best of luck!

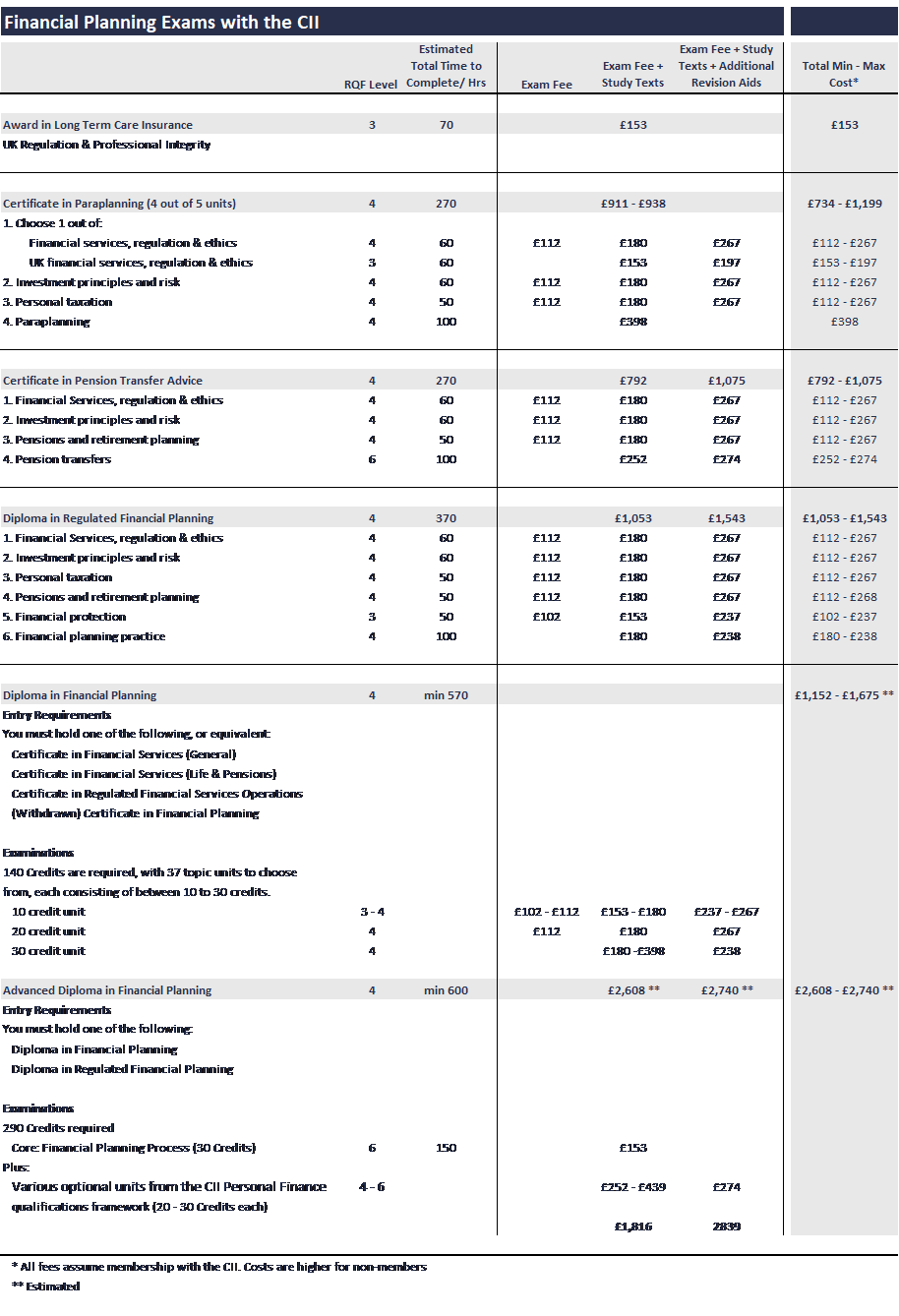

Qualifications with the CII

Award in Long Term Care Insurance

Cost: £153

Suitability: Bolt-on for Paraplanning, Financial Planning

The Award in Long Term Care Insurance is a Level 3 qualification, with the focus being to develop an understanding of long-term care contracts.

The exam lasts for 2 hours and consists of 50 multiple choice questions and 5 case studies, each comprising 5 multiple choice questions.

Certificate in Paraplanning

Minimum Cost: £734

Suitability: Paraplanning, Support Roles

The Certificate in Paraplanning is a Level 4 qualification, geared towards senior and mid-level paraplanners, with the aim of enhancing their knowledge. This qualification is also a good entry point for junior or aspiring paraplanners looking to build a career in financial planning.

Qualification success requires passes in three multiple choice examinations and a paraplanning unit comprising of three written coursework assignments.

Certificate in Pension Transfer Advice

Minimum Cost: £792

Suitability: Paraplanning, Financial Planning

The Certificate in Pension Transfer Advice is a Level 4 qualification, aimed towards retail investment advisers, paraplanners and technical consultants who wish to work in or become a specialist within the pension transfer field.

To provide advice on pension transfers, you need to hold an Activity 11 qualification, as specified by the Financial Conduct Authority (FCA).

Completion of this Certificate does meet the Activity 11 qualification requirements. However, after 1 October 2021, the FCA is raising the qualification bar in this area.

After this date, those who hold this certificate will also need to combine it with an RDR Compliant qualification for Activities 4 & 6. The fastest route to achieve this would be to complete the CII Diploma in Regulated Financial Planning; this is an RDR Complaint qualification for Activities 4 & 6 and three of its six units would have already been completed for the Certificate in Pension Transfer Advice.

Qualification success in this Certificate requires passes in three multiple choice examinations and a 2-hour written examination for the Pension transfers module.

Diploma in Regulated Financial Planning

Minimum Cost: £1,053

Suitability: Paraplanning, Support Roles

The Diploma in Regulated Financial Planning is a Level 4 qualification, aimed towards retail investment advisers, paraplanners and technical consultants. The qualification is also ideal for those wishing to work in financial planning support roles.

Qualification success in the Diploma requires passes in five multiple choice examinations (R01 – R05) and a 3-hour written case study-based examination for the financial planning module (R06). Should you have passed the Certificate in Paraplanning and/or the Certificate in Pension Transfer Advice, there will be some module overlap and this can be carried towards completion of the Diploma.

Diploma in Financial Planning

Estimated Minimum Cost: £1,152

Suitability: Paraplanning, Financial Planning, Support Roles

The Diploma in Financial Planning is a Level 4 qualification, aimed towards paraplanners and technical consultants. The qualification is also ideal for those who support financial planning processes.

To apply for the Diploma in Financial Planning, candidates must hold one of the following Certificates:

- Certificate in Financial Services (General route)

- Certificate in Financial Services (Life and pensions route)

- Regulated Financial Services Operations

- Certificate in Financial Planning (withdrawn)

Qualification success in the Diploma requires the achievement of 140 credits. There are 37 topic units to choose from, each consisting of between 10 to 30 credits. At least 80 credits need to be at Diploma level, which include the following R0 units:

- R01 – Financial services, regulation & ethics

- R02 – Investment principles and risk

- R03 – Personal taxation

- R04 – Pensions and retirement planning

- R06 – Financial planning practice

- R07 – Advanced mortgage advice

A maximum of 30 credits are allowed at Advanced Diploma level.

The units include those from The Diploma in Regulated Financial Planning, Advanced Diploma units as well as others. Therefore, prior passes in other examinations could count towards this Diploma.

Examinations differ and include multiple choice exams, written exams or coursework assignments.

Advanced Diploma in Financial Planning

Estimated Minimum Cost: £2,608

Suitability: Paraplanning, Financial Planning, Support Roles

The Advanced Diploma in Financial Planning is a Level 6 qualification, geared towards retail investment advisers who are already Level 4 qualified, as well as paraplanners, technical consultants and those in related financial planning support roles qualified at Level 4.

To apply for the Advanced Diploma in Financial Planning, candidates must hold one of the following:

- Diploma in Regulated Financial Planning

- Diploma in Financial Planning

Candidates will need to achieve a total of 290 credits for success, with all units accounting for between 20-30 credits. Financial Planning Process (AF5) is the only core examination unit and must be completed last. The multiple other option units are taken from the CII Personal Finance qualifications framework.

120 units must be at Level 6, including Financial Planning Process. The other unit options at this level include:

- AF1 – Personal tax and trust planning

- AF2 – Business financial planning

- AF4 – Investment Planning

- AF6 – Senior management and supervision

- AF7 – Pensions Transfers

- AF8 – Retirement income planning

An additional 40 credits need to be at level 4 or above, which include the J0-J12 units that are often also completed for the DipFA. Therefore, prior passes in other examinations could count towards this Diploma.

Examinations differ and are a mix of written exams or coursework assignments.

On completion of the Advanced Diploma in Financial Planning, if you have at least five years’ experience within the profession, you can apply for Chartered status with the CII. This enhances your position and highlights the level of professional standing achieved in the industry.

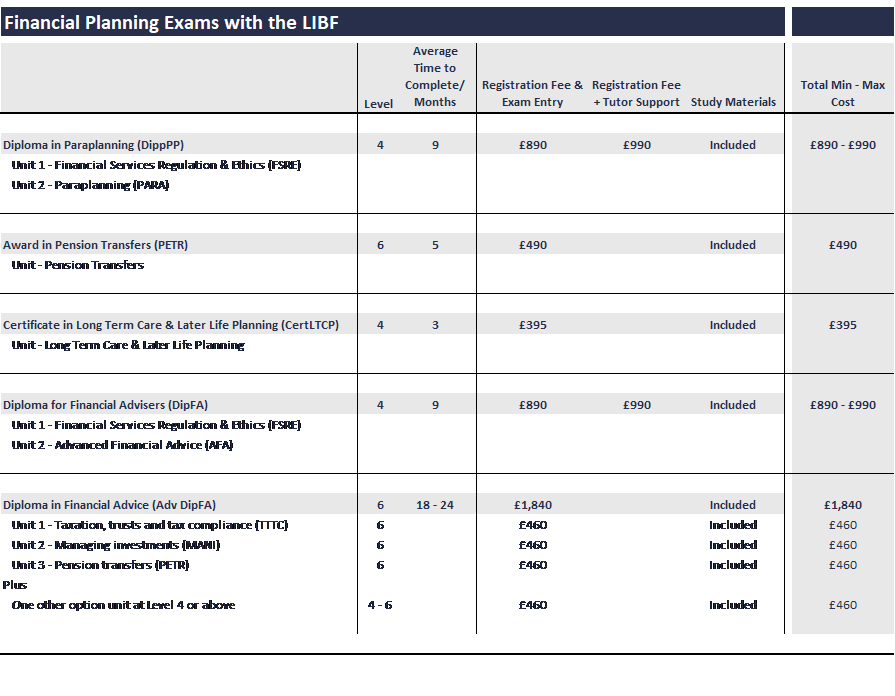

Qualifications with the LIBF

Diploma in Paraplanning (DippPP)

Minimum Cost: £890

Suitability: Paraplanning, Support Roles

The Diploma in Paraplanning is a Level 4 qualification, with the focus being to develop your knowledge and skills in the increasingly technical paraplanning sector.

The online course covers the purpose and nature of the various financial products available in the market today, ethical issues, regulation and the legal framework of the industry. You will also discover the impact of taxation on investments and how socio-economic factors affect consumers.

The exam consists of 90 multiple choice questions, with 2 case studies, each comprising 5 multiple choice questions, as well as two pieces of coursework.

Award in Pension Transfers (PETR)

Cost: £490

Suitability: Bolt-on for Paraplanning, Financial Planning

The Award in Pension Transfers (PETR) is a Level 6 qualification, aimed at anyone within the financial planning sector wishing to provide pensions advice, both generally and specifically relating to transfers.

This is an all-encompassing module for pensions that also focuses on your practical skills in dealing with clients. However, while this is a standalone qualification, to meet the FCA requirement to be able to advise on defined benefit and defined contribution schemes, you will need to complete the Level 6 Diploma in Financial Advice (Adv DipFA), of which this unit is a part of.

The exam consists of a three-hour written exam.

Certificate in Long Term Care & Later Life Planning (CertLTCP)

Cost: £395

Suitability: Bolt-on for Paraplanning, Financial Planning

The Award in Pension Transfers (PETR) is a Level 4 qualification, directed to individuals who wish to work with clients requiring long term care and later life planning.

When dealing with clients planning for their later lives, it is imperative to understand and appreciate the background and cost implications of providing care in the latter stages of life. This qualification will provide you with the know-how to assess your client’s needs and structure as well as implement appropriate long-term care and planning solutions.

The exam consists of 60 multiple choice questions, with 3 case studies, each comprising 5 multiple choice questions. Success in the LTCP can count towards the specialist option unit of the Level 6 Diploma in Financial Advice.

Diploma for Financial Advisers (DipFA)

Cost: £890

Suitability: Financial Planning, Paraplanning, Support Roles

The Diploma for Financial Advisers is a Level 4 qualification, geared towards anyone wishing to provide financial advice as part of their career. It is the minimum level qualification needed to become a financial adviser. The DipFA is ideal as an entry point for financial advisers and paraplanners, providing all the broad range of skills required for these roles. Given the strong emphasis on case study-based learning in the Diploma, there is also a useful practical element to the qualification.

The online course is split into two units. Unit 1 – Financial Services Regulation and Ethics (FSRE) concentrates on the purpose and nature of the various financial institutions, components of the financial system, regulation and legislation as well as the nature of personal and financial risk. Unit 2 – Advanced Financial Advice focuses on the products, services and legislation that inform the financial planning and advice process, investment, retirement planning and protection, communication with consumers and ethical behaviour, as well as applying your knowledge and financial planning skills.

The Unit 1 exam consists of 90 multiple choice questions, with 2 case studies, each comprising 5 multiple choice questions. Unit 2 consists of the submission of coursework following 16 weeks of study as well as a 3-hour electronic exam, based on a case study provided 6 weeks prior.

Diploma in Financial Advice (Adv DipFA)

Cost: £1,840

Suitability: Financial Planning

The Diploma in Financial Advice (Adv DipFA) is a Level 6 qualification, directed to financial advisers looking to increase their knowledge. Before attempting to complete this programme, you will need to hold the Level 4 Diploma in Financial Advice (min £890) or equivalent.

You will need to pass four units to complete the Diploma. The three compulsory units are

- Taxation, trusts and tax compliance (TTTC)

- Managing investments (MANI)

- Pension transfers (PETR)

Plus one additional specialist option unit with a minimum of 100 learning hours at Level 4 or above.

We include this qualification here as many candidates choose the Certificate in Long-term Care and Later Life Planning (CertLTCP) as their optional unit.

The compulsory units have exams that are a mixture of coursework and three-hour written exams.

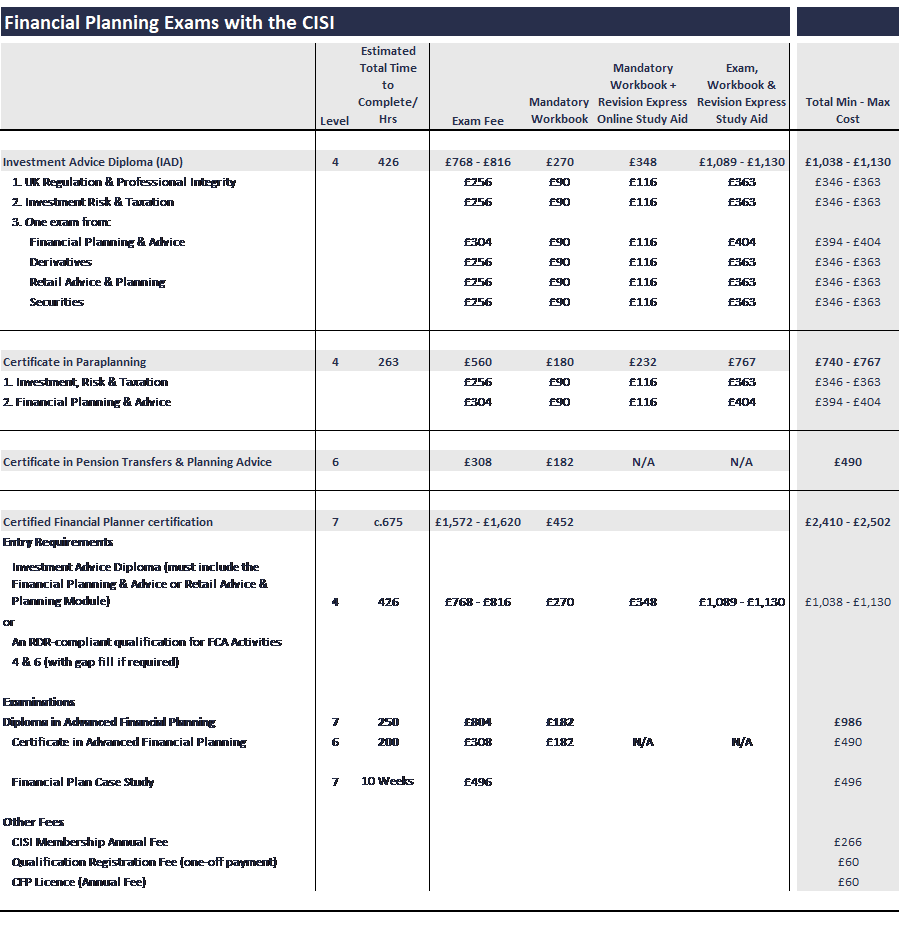

Qualifications with the CISI

Investment Advice Diploma

Minimum Cost: £1,038

Suitability: Paraplanning, Financial Planning, Support Roles

The Investment Advice Diploma (IAD) is a RDR compliant Level 4 qualification that is suitable for advisors dealing in securities or derivatives, as well as staff advising on packaged products.

It is a good stepping-stone for those wishing to pursue a career in financial planning and if taking exams with the CISI, can be used as the entry requirement to attain Certified Financial Planner (CFP) status.

To achieve the IAD qualification, you will need to pass three exams, each consisting of 80 multiple choice questions. These are:

- UK Regulation and Professional Integrity

- Investment, Risk & Taxation

Plus one of the following units. Note, candidates must pass the Financial Planning & Advice or Retail Advice & Planning modules if wishing to use the IAD to achieve CFP status thereafter.

- Financial Planning & Advice

- Derivatives

- Retail Advice & Planning

- Securities

Obtaining the IAD enables candidates to join the CISI at Associate membership level.

Should you additionally pass the IAD with the Financial Planning & Advice module, you would also be automatically awarded with the Certificate in Paraplanning.

Certificate in Paraplanning

Minimum Cost: £740

Suitability: Paraplanning, Support Roles

The Certificate in Paraplanning is a Level 4 qualification that aims to test the application of skills and technical knowledge required by paraplanners.

Candidates need to pass two exams, each consisting of 80 multiple choice questions. These are:

- Investment, Risk & Taxation

- Financial Planning & Advice

This is a widely recognised exam that combines both the broad range of technical knowledge and planning skills required to successfully carry out the role of paraplanner.

Having passed the Certificate in Paraplanning, by upgrading CISI membership status to at least Associate level, candidates can apply to become an Accredited Paraplanner and use the APP designation, providing professional recognition to peers and clients.

Obtaining the Certificate in Paraplanning is the only CISI route to becoming an Accredited Paraplanner.

Note that if you have completed the IAD with the Financial Planning & Advice module, you can automatically be awarded with this Certificate and apply to become an Accredited Paraplanner.

Certificate in Pension Transfers & Planning Advice (PTPA)

Cost: £490

Suitability: Bolt-on for Paraplanning, Financial Planning

The Certificate in Pension Transfers & Planning Advice is a Level 6 qualification that aims to build on the knowledge of those wishing to work within this specialist area.

Candidates need to pass one three-hour paper, that covers the following areas:

- Pensions planning and advice

- Pension transfer advice

- Financial protection

- Personal taxation

- Retirement planning and advice

The Certificate in PTPA is a natural progression for candidates who have passed the IAD, having taken the Financial Planning & Advice module.

Those who have successfully passed this examination will be eligible to apply for full Membership (MCSI) of the CISI.

Diploma in Advanced Financial Planning

Cost: £986

Suitability: Financial Planning

The CISI Diploma in Advanced Financial Planning is a Level 7 qualification. It is the highest-level financial planning qualification in the UK and is required to progress to Chartered Financial Planner (CFP) certification.

There are two steps to be successful in this exam:

- Complete the Certificate in Advanced Financial Planning (Level 6). This is a 3-hour narrative exam and covers the theory of financial planning, including process, retirement and estate planning, risk management, financial budgetary management and creating a financial plan.

- Financial Plan Case Study (Level 7). This assesses your ability to put the theory into practice. Information outlining client circumstances is provided and candidates are required to prepare a financial plan within 10 weeks from receipt of their case study. The plan is then submitted and assessed by an experienced independent assessor.

Those who have successfully achieved the CISI Diploma in Advanced Financial Planning will naturally continue the pathway to attaining Certified Financial Planner status.

Certified Financial Planner certification

Total Minimum Cost: £2,410

Suitability: Financial Planning

The Certified Financial Planner certification is the pinnacle standard within financial planning and is globally recognised. To achieve this status, you will need to meet all the following requirements:

Entry requirements:

- Investment Advice Diploma (Level 4) that must include either the Financial Planning & Advice module or the Retail Advice & Planning Module.

or

- An RDR-compliant qualification for FCA Activities 4 and 6 (with gap-fill if required).

Examinations

- Diploma in Advanced Financial Planning.

Ethics

- CISI membership at MCSI level or above.

- Complete the CISI Integrity Matters Test (Free for members).

Experience

- 1 year supervised or at least 3 years of unsupervised practice experience in the financial planning process.

Conclusion

Working within financial planning in the UK or abroad is becoming increasingly popular and the influx of new and diverse examinations are a testament to that. But along with this comes additional levels of responsibility, with the FCA also realising its rising importance. We suspect that before long, the requirements to meet certain professional standards through examinations for those wishing to work in either paraplanning or financial planning will continue to rise.

Regardless, most employers already expect particular levels of technical aptitude and as such, whether you’re just out of university or looking to move into paraplanning or financial planning via an admin role in wealth management, we would urge you to start on the qualification path without delay. It will certainly stand you in good stead over your career.

But even if you’re already experienced in this field, investment firms continue to raise the bar as they compete for clients who are becoming increasingly anxious in uncertain economic markets. Indeed, some firms now require exam passes at certain levels as a pre-requisite, irrespective of your level of expertise but are also willing to pay for studying expenses to enable you to do so.

We understand that deciding your career path is not an easy one. At Recruit UK, we have many years’ experience navigating the financial planning and paraplanning sectors. So why not utilise the expertise of a specialist recruitment company to help you map out your future career plan? Find out more how we can assist by contacting a member of our approachable team.

Click here to talk to us.

Sources:

www.cisi.org

https://www.cisi.org/cisiweb2/cisi-website/study-with-us/getting-started/price-list

https://www.ftadviser.com/your-industry/2018/12/24/cisi-reports-significant-growth/

https://www.cii.co.uk/

https://www.libf.ac.uk/

https://www.handbook.fca.org.uk/handbook/TC/App/4/1.html

https://www.thepfs.org/media/10122021/getting-you-started-in-paraplanning.pdf

Phone and email discussions with CISI, CII and LIBF directly.