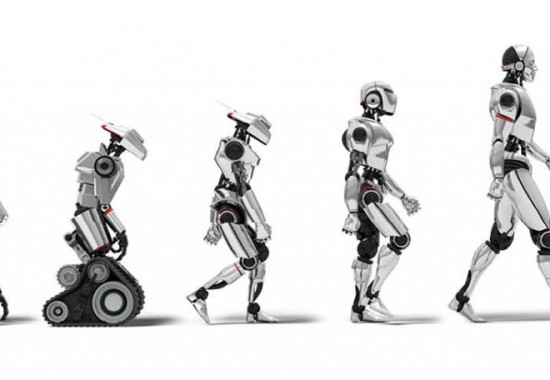

The capabilities of technology are growing at an unmeasurable rate. It is predicted that by 2020 most skilled professionals career paths with be disrupted by smart machine technology. These technologies are paving the way for automation to replace knowledgeable workers who once performed the role, including making executive decisions.

From the perspective of a Financial Advisor, or any other person in their career, this may be troubling, because as humans we are still learning and advancing, but not getting smarter at a pace that can possibly keep up with the growth in technology. In other words, computers are getting smarter at a faster rate than humans.

For some people this has raised the question of whether we will reach a point at which artificial intelligence surpasses human intelligence. This challenge of rapid growth in technology could potentially have a dramatic impact on the role of Financial Advisors. While todays ‘robo-advisors’ are really operating as ‘robo allocators,’ where they provide an asset allocation service, it is only a matter of time before this technology expands and the rise of robo-planning begins.

This does raise the looming question of what will be the role of the human financial adviser in the future? Before long there will be nothing a knowledge worker can do that a computer can’t do better, faster, easier, and cheaper.

Yet, the missing element in the equation is the way the human brain is wired- socially. Having evolved by working together, we are programmed to relate uniquely to other human beings. What this implies in the long run, is that it may not be a matter of what computers can do better than a human, but what is preferred in terms of personal engagement. As after all, this is the way we are built to operate.

The key distinction of being a relationship worker is that even if the computer knows and understands all the facts, it cannot relate and share information in the same way as a human. The reality when it comes to financial planning, is that one of the greatest challenges is helping clients to achieve their goals, when they don’t even know what their goals are in the first place. In real life, our financial problems and goals are constantly changing, which aren’t always rational. It would be hard for a robo-planner to answer these questions when the client doesn’t even know the right questions to ask.

In a world where the role of the Financial Advisor is increasingly more about the human relationship, it is vital that they obtain the skill of empathy. Empathy is the ability to understand and share feelings of another. It is about putting ourselves in someone else’s position and considering things from their perspective in order to generate an appropriate response.

The forward march of computing power is already rippling through other professions such as law and medicine, suggesting it is only a matter of time before the robots arrive! The prediction is that Financial planning will shift from being about delivering expert information to focus on empathy skills and building relationships. The irony of this robo rise is that early on this piece of technology helped make us more efficient, but now it threatens to complete knowledge work better than knowledge workers themselves.

What are your opinions?